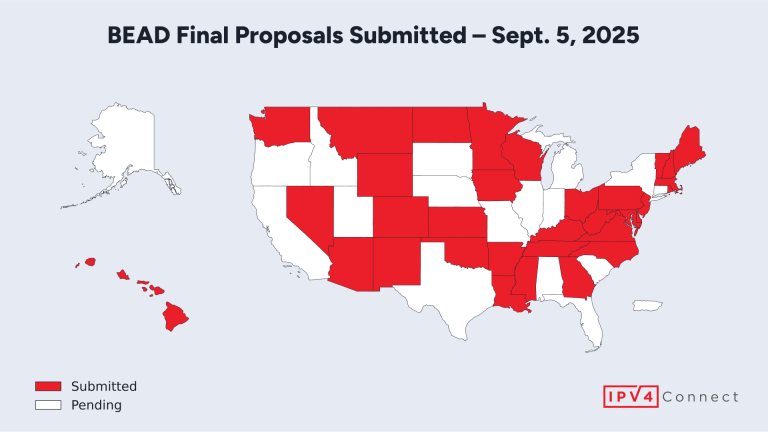

States Submit Final BEAD Proposals to NTIA

36 states finalize BEAD plans, submitting proposals to NTIA detailing broadband strategies, funding allocations, and chosen technology.

36 states finalize BEAD plans, submitting proposals to NTIA detailing broadband strategies, funding allocations, and chosen technology.

Montana awarded Starlink $119M in BEAD funds to connect 20,000 rural locations, favoring satellite over fiber to save costs in broadband expansion.

Minnesota’s $392 Million broadband push plans to bring fiber to rural farms , fueling business growth and closing the digital divide

Nebraska proposed spending just $43.8M of $405M in BEAD funds, leaving rural communities with satellite over fiber broadband.

Pennsylvania provisionally approves $793.4M in BEAD grants, aiming for universal broadband access with fiber, wireless, and satellite projects.

West Virginia recommends nine providers for $624.7M BEAD awards, with Frontier and Citynet leading, and fiber dominating most projects.

Amazon Kuiper and Starlink secured half of Colorado’s BEAD locations, but just 8% of $826M broadband funding.

Virginia’s $613M BEAD funds prioritize fiber over satellite, with Starlink winning a small share under updated broadband funding rules.

Oklahoma adapts broadband strategy to shifting federal policy; fiber, wireless, satellite to connect rural and underserved communities.

ARIN increases annual fees by 5% for 2026, maintains fee cap, and extends IPv6 waiver for 3X-Small organizations.

Email me when new IPv4 inventory matches my criteria.

Error: Block data unavailable.

You’ll now receive email alerts when new IPv4 inventory matches your preferences.

Are you absolutely sure you want to delete your account? This action cannot be undone.