Most of BEAD Funds Favor Fiber Despite Satellites Eligibility

Virginia Outlines $613 Million BEAD Spending Plan

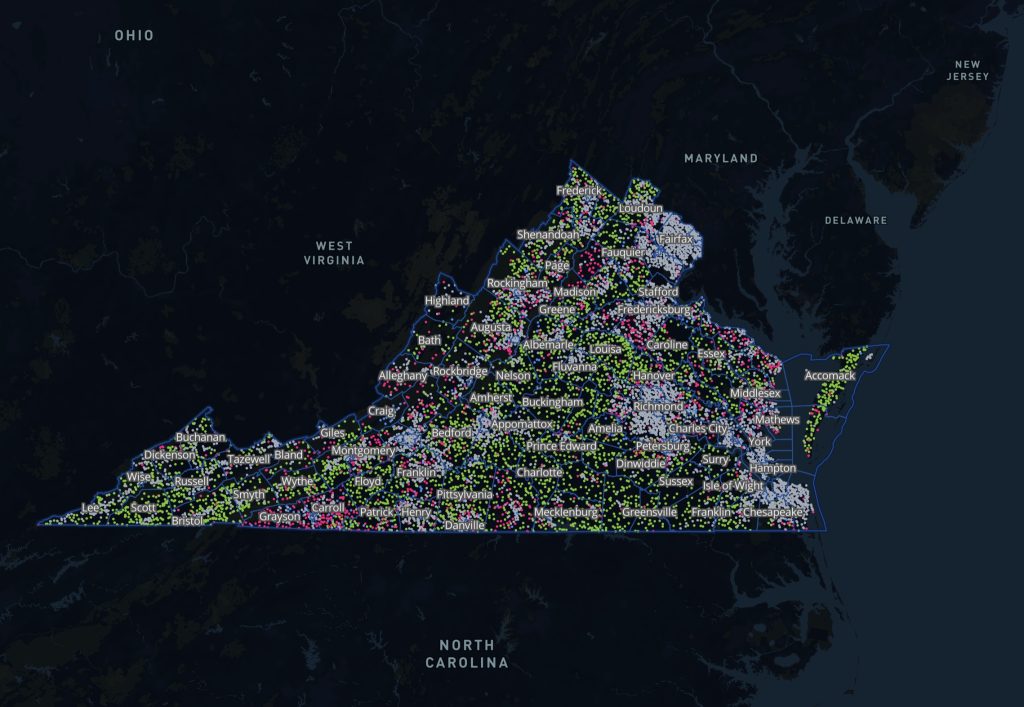

Without much fanfare, Virginia has finalized its distribution of $613 million from the federal Broadband Equity, Access, and Deployment (BEAD) initiative. Its “Benefit of the Bargain” round award recommendations reflect the updated BEAD rules announced in June, which removed the original preference for fiber and allowed for “technology neutrality” across fiber, satellite, cable, and fixed wireless solutions. While SpaceX’s Starlink and Amazon’s Project Kuiper claimed a share of the funds, fiber-based projects received the lion’s portion of the awards.

Earlier this year, the Trump administration overhauled BEAD rules to allow “technology-neutral” competition. This eliminated the original preference for fiber infrastructure, giving satellite operators equal footing in the bidding process. The U.S. Commerce Department has described satellite internet as a more affordable and faster-to-deploy option for remote areas. This adjustment expanded bidding opportunities for providers such as Starlink and Kuiper across the country.

Fiber Still Dominates Despite Neutrality Rules

While the rule change opened the door for more satellite and cable participation, Virginia’s plan still overwhelmingly prioritizes fiber. A research note from New Street Research estimates that 81% of the awarded locations will be connected via fiber broadband, 10% via satellite, 8% via cable, and 1% via fixed wireless.

Virginia is one of just two states—alongside Louisiana—that still recommends allocating the majority of BEAD funding to fiber builds under the new rules. State officials cite fiber’s long-term scalability and performance advantages as the main reason for its continued priority.

Starlink Gets a Minimal Share

In Virginia’s awards, Starlink was allocated just under $3.3 million to serve 5,579 locations—about $584 per site. Project Kuiper will receive $4.4 million to connect roughly 7,000 sites at $641 each. In total, satellite services account for only $7.7 million—around 1.3% of the state’s total BEAD funding.

Fiber projects dominate the remaining allocation. All Points Broadband alone secured over $171 million to bring service to nearly 20,000 locations at an average cost of $8,655 per site. Many of these fiber connections are expected to reach speeds up to 10 gigabits per second. Officials say the state’s strong preference for fiber reflects its superior long-term performance and scalability.

Speed, Capacity, and Environmental Factors

According to Drew Garner of the Benton Institute for Broadband and Society, Virginia’s award criteria emphasized not just cost, but also speed, latency, and the ability to scale over time. Environmental considerations—such as dense tree cover—also factored in, since such conditions can disrupt satellite signals. SpaceX points to its beam-switching technology as a way to address these challenges, though some experts remain unconvinced.

Fiber offers symmetrical gigabit speeds and does not degrade with higher usage, making it the favored option for permanent broadband infrastructure. By contrast, satellite networks can become congested when too many users share a beam. In parts of the Pacific Northwest, Starlink has even added a $1,000 congestion surcharge to discourage sign-ups in over-capacity zones.

Affordability Questions Remain

Under the updated BEAD guidelines, satellite providers must guarantee download speeds of at least 100 Mbps and upload speeds of 20 Mbps for all funded households. In Virginia, eligible residents will get a Starlink dish at no cost for the full 10-year service period.

However, states can no longer set pricing for low-income broadband plans. Providers must simply offer at least one qualifying affordable option, which could be one of their existing packages. With Starlink’s standard residential service priced at $120 per month, advocates worry that affordability could still block access for many households. Garner emphasized that cost, not availability, is often the biggest obstacle for underserved communities.

Ongoing Dispute Over BEAD Policy Shift

Evan Feinman, who previously led the BEAD program but resigned after the rule change, praised Virginia’s choices given the new framework but criticized the required satellite inclusion. He argued that replacing fiber with satellite for certain households could result in slower speeds and higher monthly bills.

Supporters of the change, including Joe Kane of the Information Technology and Innovation Foundation, highlight cost savings. Governor Glenn Youngkin also endorsed the results, citing a $200 million reduction in broadband spending compared to earlier proposals—about a 25% taxpayer savings.

The Commerce Department has set September 4 as the deadline for states to submit final BEAD plans, with extensions possible. In the meantime, Starlink and Kuiper are actively competing for large-scale awards in other states, particularly Texas, where they aim to connect hundreds of thousands of homes.

Major Awardees and Technology Mix

Twenty-one providers are slated to receive funding in Virginia’s BEAD awards. Comcast leads the list, with grants to serve 24,343 locations, followed by All Points Broadband with 19,801 locations. Both low Earth orbit (LEO) satellite operators in the BEAD program—Amazon’s Project Kuiper and SpaceX’s Starlink—will receive funding to serve 6,957 and 5,579 locations respectively.

Other major fiber recipients include RiverStreet Networks (13,509 locations), Ztel (12,985 locations), Connect Holding/Brightspeed (4,963 locations), and Verizon (4,645 locations). Cable and fixed wireless providers also secured smaller portions of the funding, ensuring a technology mix across the state’s buildout plans.

Full List of Virginia BEAD “Benefit of the Bargain” Awardees

| Company | Locations |

|---|---|

| Comcast | 24,343 |

| All Points Broadband | 19,801 |

| RiverStreet Networks | 13,509 |

| Ztel | 12,985 |

| Amazon Kuiper* | 6,957* |

| EMPOWER | 6,512 |

| SpaceX* | 5,579* |

| Connect Holding (Brightspeed) | 4,963 |

| Verizon | 4,645 |

| Hosted Backbone/Port 80 | 4,573 |

| Eastern Shore of Va. Broadband Authority | 4,119 |

| GigaBeam Networks | 3,986 |

| Point Broadband | 3,757 |

| WiFiber | 2,759 |

| Global Technical Networks/SPARQ | 2,304 |

| IBT Group | 1,519 |

| Kinex | 1,278 |

| Citizens Telephone | 840 |

| FiberLync | 831 |

| MGW Communications | 600 |

| Scott County Telephone Cooperative | 543 |

| Firefly (CVEC) | 486 |

| IWISP | 279 |

| Cogeco US (Delmar) dba Breezeline | 48 |

Source: Virginia DHCD.

*Satellite providers

More on BEAD and Broadband

- More of our recent stories about BEAD and public broadband programs

- For up-to-date information on the $42 billion BEAD Program, check Brander Group’s BEAD funding progress dashboard