Predictions about the decline of IPv4 have circulated for years. As IPv6 adoption expanded, many assumed IPv4 usage would gradually contract, leading to fewer transfers and weaker market activity. Instead, the opposite trend has emerged. The IPv4 market continues to demonstrate staying power that few anticipated.

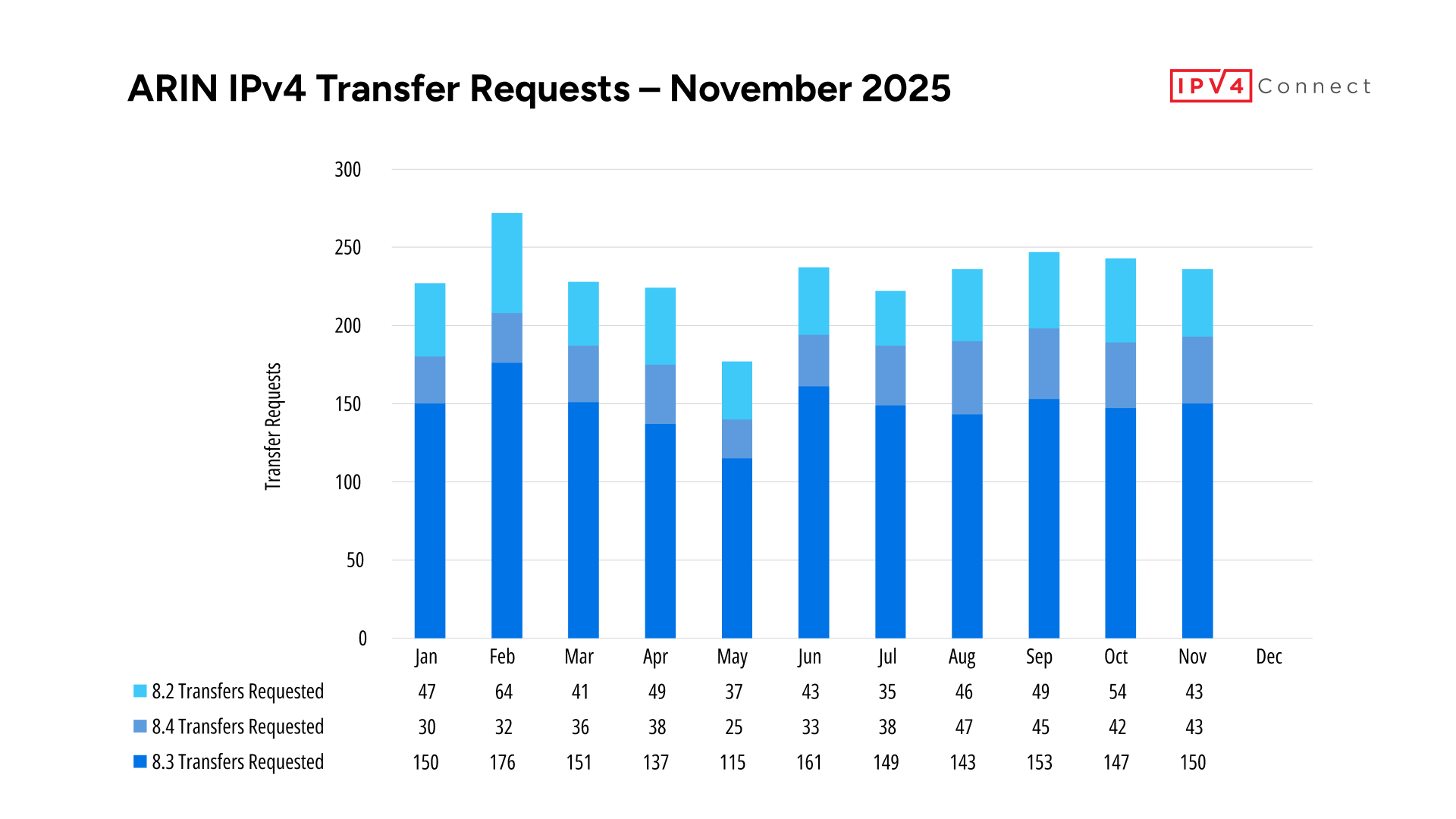

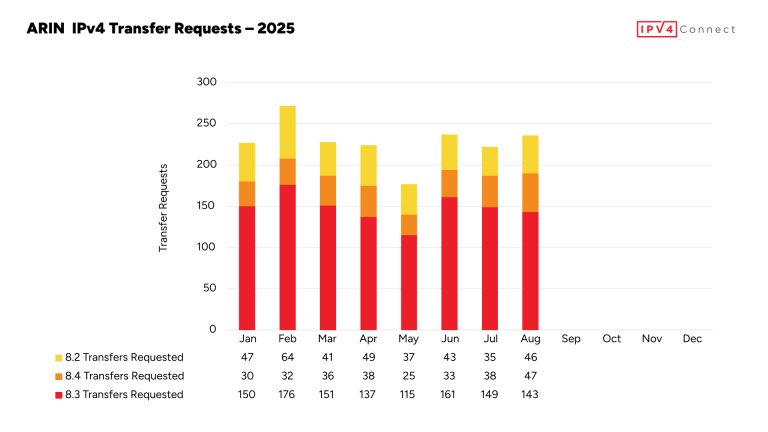

Recent transfer data reinforces this reality. Approximately 150 IPv4 transfer requests were recorded last month, closely matching the year-to-date monthly average of 148 transactions. This level of alignment reflects a market operating at a steady equilibrium rather than one experiencing cyclical spikes. More importantly, current activity levels are 6% higher than the average seen over the past three years, even though that earlier period already represented a mature and well-established trading environment. The implication is clear: IPv4 demand is not diminishing—it is incrementally expanding.

This durability is rooted in necessity, not speculation. Organizations across multiple sectors continue to rely on IPv4 to support real-world operations. Enterprises scaling digital services, cloud platforms onboarding customers, content providers delivering global traffic, and network operators maintaining compatibility all face the same constraint—IPv4 remains essential. While IPv6 plays an increasing role within internal networks, it has not replaced IPv4 as the universal access layer of the internet.

One of the strongest signals of this ongoing dependence came from Amazon’s acquisition of roughly 5 million IPv4 addresses. With an estimated transaction value between $50 million and $60 million, the purchase reflects long-term infrastructure planning rather than short-term market timing. Even the most advanced cloud providers recognize that controlling IPv4 resources is a strategic advantage. Over the past two years, a limited number of large buyers—primarily hyperscalers—have also influenced market pricing, leveraging scale to secure favorable acquisition terms.

The outlook ahead suggests additional pressure points may be forming. BEAD funding is expected to begin distribution in Q1 2026, injecting approximately $20 billion into broadband expansion initiatives. As service providers deploy new networks in previously underserved areas, interoperability with the broader internet will be mandatory from day one. In practice, that means securing IPv4 address space.

Although overall supply remains available, the balance may shift. Legacy address holders continue to participate in the transfer market, and transaction pipelines remain active. However, demand linked to BEAD-funded buildouts—combined with accelerating AI infrastructure growth—is likely to concentrate demand in specific regions and block sizes. Clean, well-documented IPv4 space may become increasingly competitive. Historically, infrastructure-led demand surges have resulted in pricing pressure even when total supply appeared sufficient on paper.

The broader takeaway is difficult to ignore. The modern IPv4 market is no longer driven by scarcity narratives or panic buying. It is supported by consistent demand, institutional participation, and long-term network planning. As public investment ramps up and major technology firms continue to allocate capital toward IPv4 assets, pricing stability—and potential upside—should remain firmly on the radar.

IPv4 is no longer a transitional technology. It has become a durable infrastructure asset that continues to underpin global internet expansion.