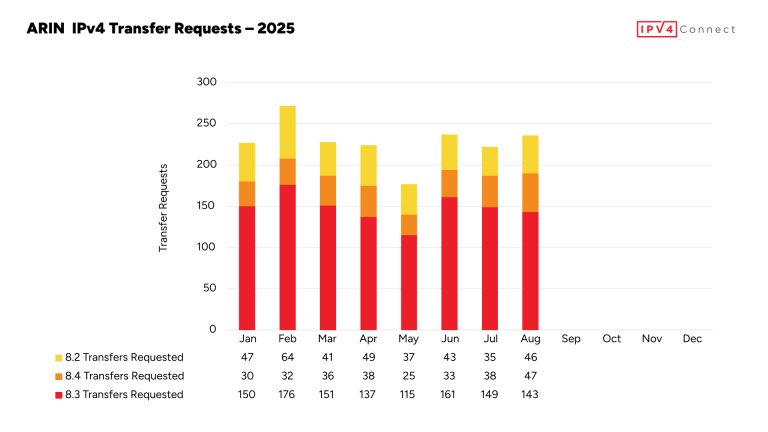

Demand For IP Addresses Hold Steady During 2025

Last month’s transfer activity reflects another period of consistent performance in the IPv4 market, reinforcing how durable address demand remains despite broader economic shifts. Although monthly transfer counts naturally vary, the indicators that best reflect underlying market health continue to hold steady.

ARIN logged 147 IPv4 transfer requests in October—slightly below September’s 153, yet almost perfectly aligned with the 2025 monthly average of roughly 148. This places October well above the typical post-summer baseline and firmly within the “growth-side plateau” that has characterized the market throughout 2024 and 2025. The overarching message is clear: IPv4 demand remains stable, resilient, and largely unaffected by short-term economic turbulence.

A Shift in Buyer Dynamics

Looking ahead to 2026, one of the most notable trends is the continued reduction in purchasing activity from major hyperscalers such as Amazon Web Services, Google Cloud, and Microsoft Azure. After years of aggressive acquisitions, these organizations are now focused on reallocating and optimizing the substantial inventories they accumulated, rather than adding more.

This shift has not weakened overall demand. Instead, it has redistributed activity across a broader buyer base. Mid-size cloud providers, regional ISPs, enterprises, cybersecurity firms, and SaaS platforms are increasingly driving monthly transfers. These organizations are expanding networks, launching new services, and undertaking modernization efforts. And because IPv6 adoption remains limited—combined with the performance and operational constraints of CG-NAT—IPv4 continues to underpin the vast majority of internet-facing infrastructure.

Stable Demand, Emerging Price Opportunities

Pricing trends across 2024 and 2025 mirror the stability seen in transfer volumes. Mid-market demand has kept prices for /24s through /19s in a relatively narrow band, fluctuating only 10–15% over the year. However, a different pattern has emerged for larger subnets.

Blocks sized /18 and above have seen a significant drop in price, with many now trading well below $20 per IP. This represents one of the most notable price softening events in the large-block segment in recent years, driven by reduced hyperscaler activity and increased supply from legacy holders.

For organizations with substantial future requirements, this environment presents a rare strategic buying opportunity. The current pricing window is especially important given the expected increase in demand tied to BEAD-funded broadband expansion beginning in 2026. As regional ISPs, rural networks, and broadband providers bring new infrastructure online, supply constraints are likely to intensify and pricing will likely rise accordingly.

What to Expect in 2026

Market indicators point toward continued steady demand next year, paired with potential upward pricing pressure as BEAD projects scale and more providers compete for available IPv4 space. The current price softness for /18s and larger blocks is unlikely to persist once these deployments begin drawing significant volume from the market.

Organizations should view today’s sub-$20 pricing as the lower boundary of the current cycle. Securing required address space now—while supply remains high and competition remains limited—is the most prudent approach. Delaying acquisitions until mid- or late-2026 may result in higher prices, tighter inventory, and longer procurement timelines.

In short, the present market should be treated as a temporary buying window rather than a new long-term baseline.