BEAD’s Infrastructure Boom Creates Workforce Opportunity, Challenges, Pew Finds

The Broadband Equity, Access and Deployment (BEAD) program isn’t just about fiber—it’s about people.

A new report from The Pew Charitable Trusts warns that the $42.5 billion broadband expansion will test the limits of the U.S. telecommunications workforce, creating tens of thousands of new jobs but also exposing a widening skills gap that could delay deployments.

According to Pew, 41 states and the District of Columbia have already flagged workforce challenges in their BEAD or digital equity plans. As states begin issuing construction awards, the question is no longer just how to fund broadband—it’s whether there are enough trained workers to build it.

A Surge in Demand for Skilled Labor

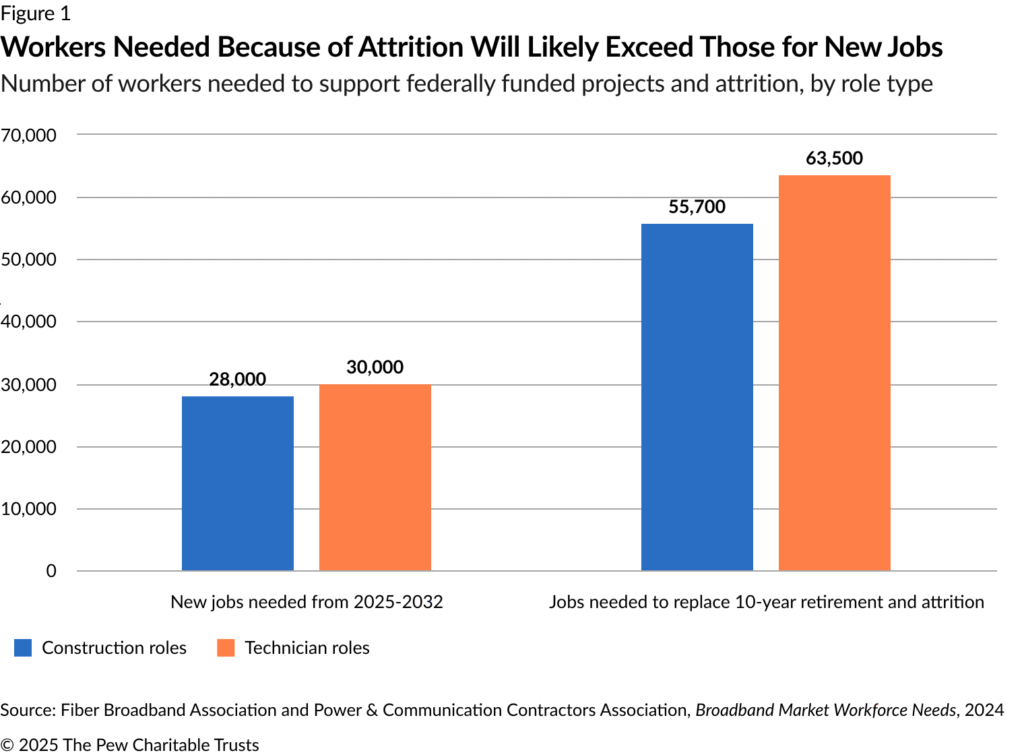

Pew’s analysis projects an unprecedented need for technicians, engineers, and construction crews between 2025 and 2032—the peak BEAD buildout window.

The report cites an earlier industry study from the Fiber Broadband Association showing that the number of workers leaving the field over the next decade will exceed the number of new jobs created, compounding the shortage.

Among the most critical positions are fiber and wireless technicians, network architects, heavy-equipment operators, and radio-frequency engineers. These are precisely the trades required to connect rural and remote communities where BEAD funds are now flowing.

Aging Workforce, Shrinking Pipeline

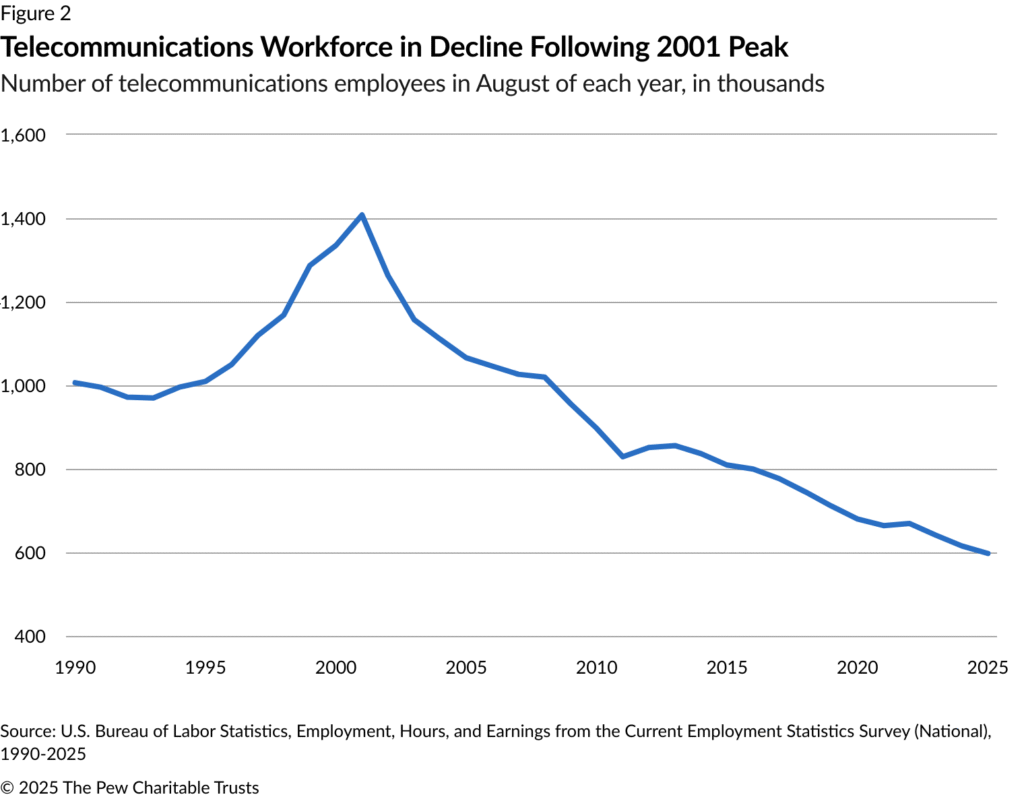

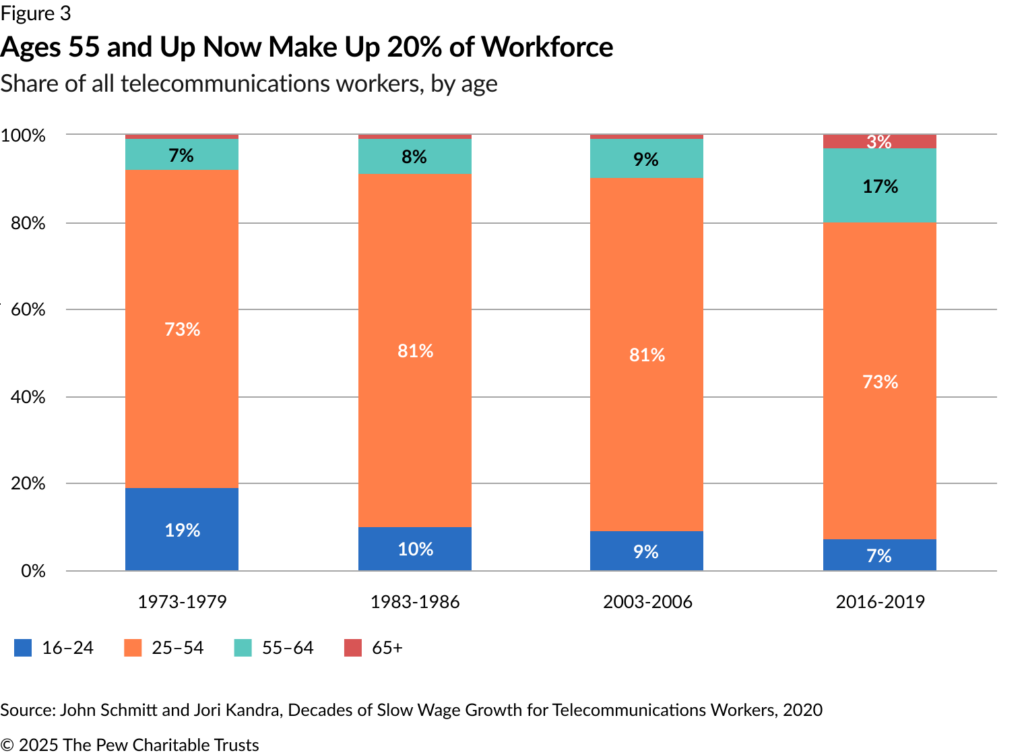

The U.S. telecom labor force has been declining since its 2001 peak, a trend Pew links to outsourcing and reduced unionization. Nearly one-fifth of today’s telecommunications workers are over 55, and many are expected to retire before BEAD-funded projects are complete.

Training new recruits takes time—typically 12 to 24 months—meaning that states must accelerate programs now to have certified technicians ready for 2026–2028 construction schedules. Pew frames this as both a risk and an opportunity: BEAD could revitalize an industry that has been shedding workers for two decades.

Data Gaps and Policy Blind Spots

Even as demand grows, policymakers struggle to measure it. The Bureau of Labor Statistics has no dedicated “broadband” occupation code, forcing agencies to rely on overlapping categories like “telecommunications installer” or “construction laborer.” This data gap makes it difficult to plan workforce development or forecast needs by region.

Research suggests that closer coordination between federal and state agencies, broadband offices, and training institutions to standardize job definitions and credentialing. Without that, the report warns, even strong state planning may fall short of BEAD’s labor requirements.

Flat Wages in a Competitive Market

Despite surging demand, broadband-related wages have remained largely flat. Pew cites federal data showing that pay for telecommunications technicians and line workers has grown slower than in other infrastructure sectors.

That could pose a retention challenge as BEAD projects compete with road, energy, and water construction jobs created by the Infrastructure Investment and Jobs Act. Pew recommends more competitive compensation and long-term career pathways to attract and retain skilled broadband workers.

Building the Workforce Behind Broadband

For all its urgency, Pew’s findings point to a positive long-term shift: BEAD could become one of the most significant employment programs in modern telecommunications history.

By pairing infrastructure investment with targeted workforce strategies, states have an opportunity to strengthen local economies and create durable broadband careers across rural America. “More cohesive data could lead to training programs that address both the short- and long-term skills shortages in the broadband workforce,” Pew concludes.

Read the full Pew issue brief: Demand for Broadband Workforce Expected to Rise to Meet BEAD Requirements

Original story: ©2025 The Pew Charitable Trusts — graphics and data used under fair use for commentary and reporting.

More on BEAD and Broadband

- More of our recent stories about BEAD and public broadband programs

- For up-to-date information on the $42 billion BEAD Program, check Brander Group’s BEAD funding progress dashboard

- BEAD Rule Changes: What ISPs Should Know

- Telecom at Risk: Addressing Evolving Cyber Threats

- Nevada to Invest $327 Million in Broadband Expansion

Leave a Reply