How Connecticut’s $154 million fiber buildout is reshaping broadband competition

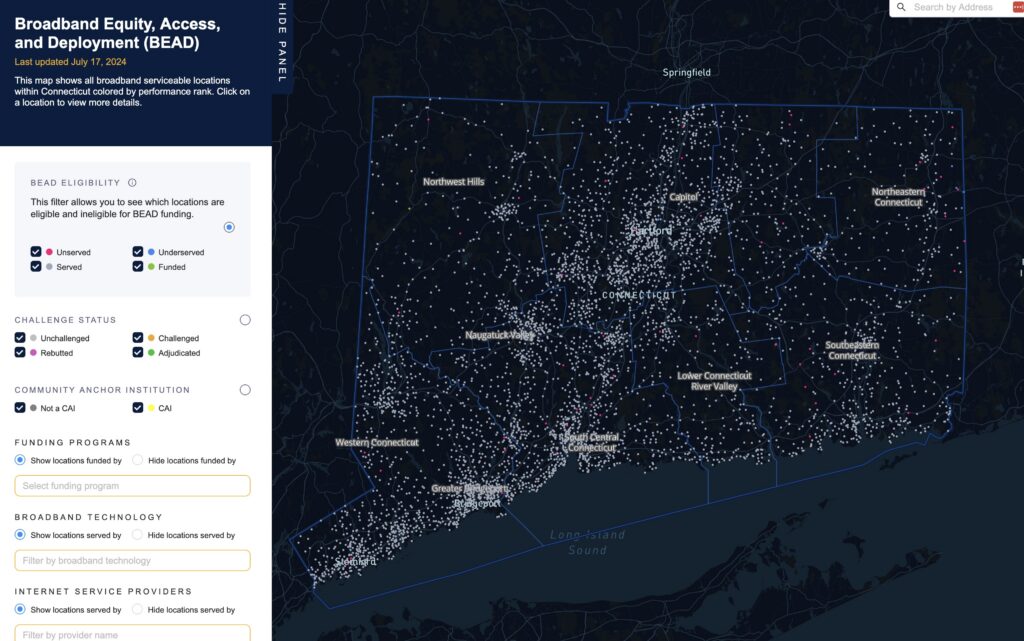

Connecticut has emerged as a proving ground for how U.S. infrastructure dollars are reshaping last-mile networks. Backed by a combined $154 million in state and federal funding, the state is targeting more than 6,200 new high-capacity connections for homes, businesses, and community anchor institutions. That includes $10 million through the ConneCTed Communities Grant Program and $144 million from the federal BEAD initiative—money that underscores a policy tilt toward fiber rather than temporary wireless fixes.

For IPv4 Connect readers, this story isn’t just about one state’s connectivity upgrade. It’s an indicator of how fiber, fixed wireless, and IP address consumption will interact as large telecom providers adjust their footprints.

Comcast: Building Fiber and Bundles

Comcast’s aggressive expansion in Connecticut demonstrates how large ISPs are treating state-funded markets as springboards for new service bundles. After securing $21 million in 2024 grants, Comcast extended service to five Eastern Connecticut towns and now plans another 12,000 locations by 2026. Management calls 2025 an “investment year,” focusing capital on broadband and wireless buildouts even while absorbing short-term subscriber losses.

For IPv4 stakeholders, that means more address allocations tied to new high-speed lines and edge devices, and a chance to monitor how bundling (mobile, security, streaming) drives address utilization and customer retention.

Verizon: FWA-Fiber Synergy and Frontier Acquisition

Verizon is blending fixed wireless access (FWA) with fiber to reach deeper into rural and suburban areas. Its pending acquisition of Frontier Communications’ fiber assets adds millions of passings and two million active fiber customers—instantly boosting Verizon’s footprint in markets like Connecticut.

With a projected $2 billion in 2025 tax savings earmarked for network upgrades, Verizon’s dual-track approach—FWA for immediate market share and fiber for long-term stability—may accelerate demand for both IPv4 and IPv6 blocks as new edge nodes and CPE devices come online.

Charter: Efficiency Over Aggression

Charter Communications remains a significant player but is taking a more conservative tack. It is simplifying pricing and streaming offerings while trimming capital spending after 2025. This may improve free cash flow but could also limit its ability to match Comcast’s and Verizon’s deployment pace—a key differentiator in markets where high-capacity fiber is becoming standard.

For the address market, Charter’s slower build could translate to steadier, incremental demand rather than large block acquisitions.

A Bellwether for the $44 Billion Fiber Market—and IP Address Demand

Analysts project the U.S. fiber broadband market will surpass $44 billion by 2033, growing at a double-digit compound annual rate. Connecticut’s rollout illustrates how that growth is likely to unfold: public funding catalyzing private investment, companies racing to capture underserved areas, and investors scrutinizing which business models balance short-term earnings with long-term infrastructure value.

The takeaway is twofold:

- Fiber expansion drives more connected endpoints, which in turn increases the need for both IPv4 and IPv6 resources, even as address space becomes scarcer.

- The way major ISPs sequence fiber and fixed wireless deployments can affect when and how address blocks hit the market—whether through transfers, leasing, or new allocations.

In Short

Connecticut’s fiber surge is more than a regional upgrade—it’s a bellwether for how telecom giants adapt to a future where high-capacity networks drive both customer loyalty and address utilization. As Comcast, Verizon, and Charter execute different strategies, IPv4 market participants should watch not just pricing trends but how infrastructure investment shapes long-term demand for Internet number resources.

More on BEAD and Broadband

- More of our recent stories about BEAD and public broadband programs

- For up-to-date information on the $42 billion BEAD Program, check Brander Group’s BEAD funding progress dashboard

- IPv4 Demand Holds Steady as Market Awaits Next Shift

- IPv4 Transfer Surge Continues Despite BEAD Setbacks

Leave a Reply