Alaska’s draft Broadband Equity, Access and Deployment (BEAD) awards reveal the steepest unit costs in the nation—over $113,000 per address in some cases—forcing a reassessment of how far fiber should go when lower-cost, faster alternatives exist.

Extraordinary Costs, Uneven Returns

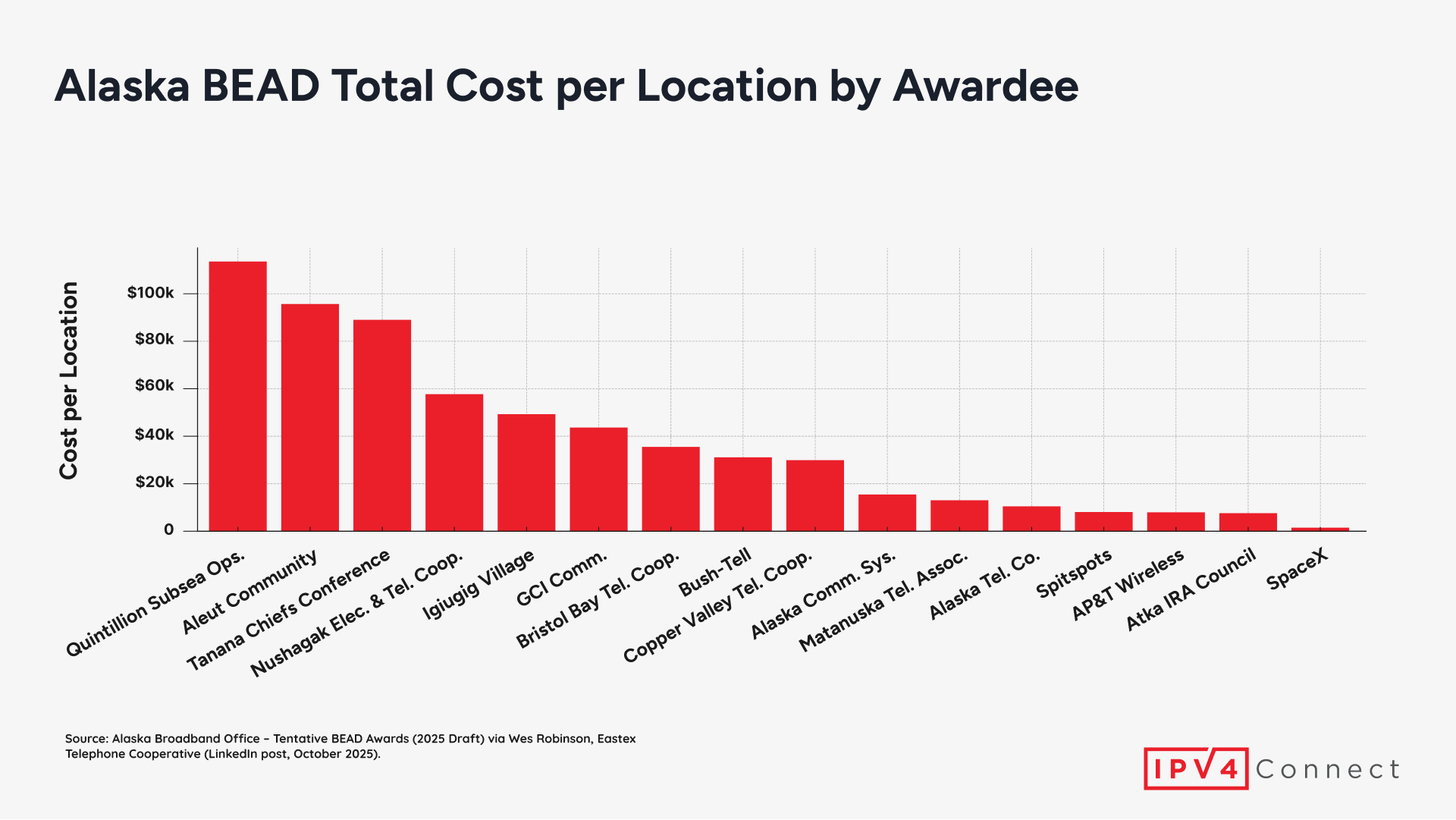

A preliminary analysis of Alaska’s BEAD allocations, circulated by Wes Robinson of Eastex Telephone Cooperative, totals $776.8 million in federal funds and $49.3 million in provider matches to connect 44,929 locations statewide.

That equates to roughly $18,387 per location, with private contributions representing only 6 percent of total spend.

While averages mask dispersion, individual awards show wide cost variation:

| Awardee | Total Cost per Location (USD) |

|---|---|

| Quintillion Subsea Ops. | $113,578 |

| Aleut Community | $95,686 |

| Tanana Chiefs Conference | $88,903 |

| Nushagak Electric & Tel. Coop. | $57,715 |

| GCI Communications | $43,671 |

| Matanuska Tel. Assoc. | $13,044 |

| SpaceX (LEO) | $1,500 |

The state’s “Benefit of the Bargain” (BoB) cost-discipline process, administered by the NTIA, will likely scrutinize these figures closely. Quintillion’s proposal, for instance, exceeds New Mexico’s highest per-address benchmark by more than 180 percent.

Context: Geography Explains Much, but Not Everything

Alaska’s logistical challenges are well-known: vast distances, permafrost, sea crossings, a limited construction season, and a dispersed population. Those factors make fiber installation uniquely expensive.

Even so, the state’s cost structure is far above that of peers. New Mexico’s plan averaged near $10,000 per location, while Oregon, Alabama, and Nebraska fell between $15,000 and $25,000.

These disparities raise a policy dilemma: at what point do diminishing returns from fiber justify pivoting to mixed technologies—fixed wireless, microwave, or low-Earth-orbit (LEO) satellite—that deliver service sooner and at a fraction of the cost?

Technology Neutrality Meets Political Reality

BEAD funding is explicitly technology-neutral. The NTIA requires states to evaluate proposals based on objective performance metrics—throughput, latency, reliability—not on medium preference.

In practice, however, fiber remains the de facto choice because of its longevity and bipartisan appeal. Alaska’s plan tests the limits of that bias.

Starlink’s $1,500 per-location estimate demonstrates that LEO systems can now serve remote households at under 2 percent of the cost of certain fiber builds. While satellites cannot match fiber’s capacity, they can satisfy BEAD’s minimum performance requirements, especially for unserved census blocks where economics make terrestrial deployment impractical.

Implications for Policy and Market Participants

For state broadband offices:

Projects with six-figure unit costs may fail federal reasonableness tests. Diversified deployment models will likely score better under NTIA’s final review.

For service providers:

Cost transparency and hybrid engineering approaches—fiber backbones with fixed-wireless or LEO endpoints—will be critical to securing awards and sustaining compliance through buildout.

For communities and end users:

Technology choice directly affects timelines. Every $100,000 fiber extension to a single remote home could otherwise fund connectivity for dozens of households via lower-cost methods.

More on BEAD and Broadband

- More of our recent stories about BEAD and public broadband programs

- For up-to-date information on the $42 billion BEAD Program, check Brander Group’s BEAD funding progress dashboard

- Fiber Dominates Virginia’s $613M Broadband Allocation

- Ohio Receives $793 Million in Broadband Funding

- States Submit Final BEAD Proposals to NTIA

Leave a Reply