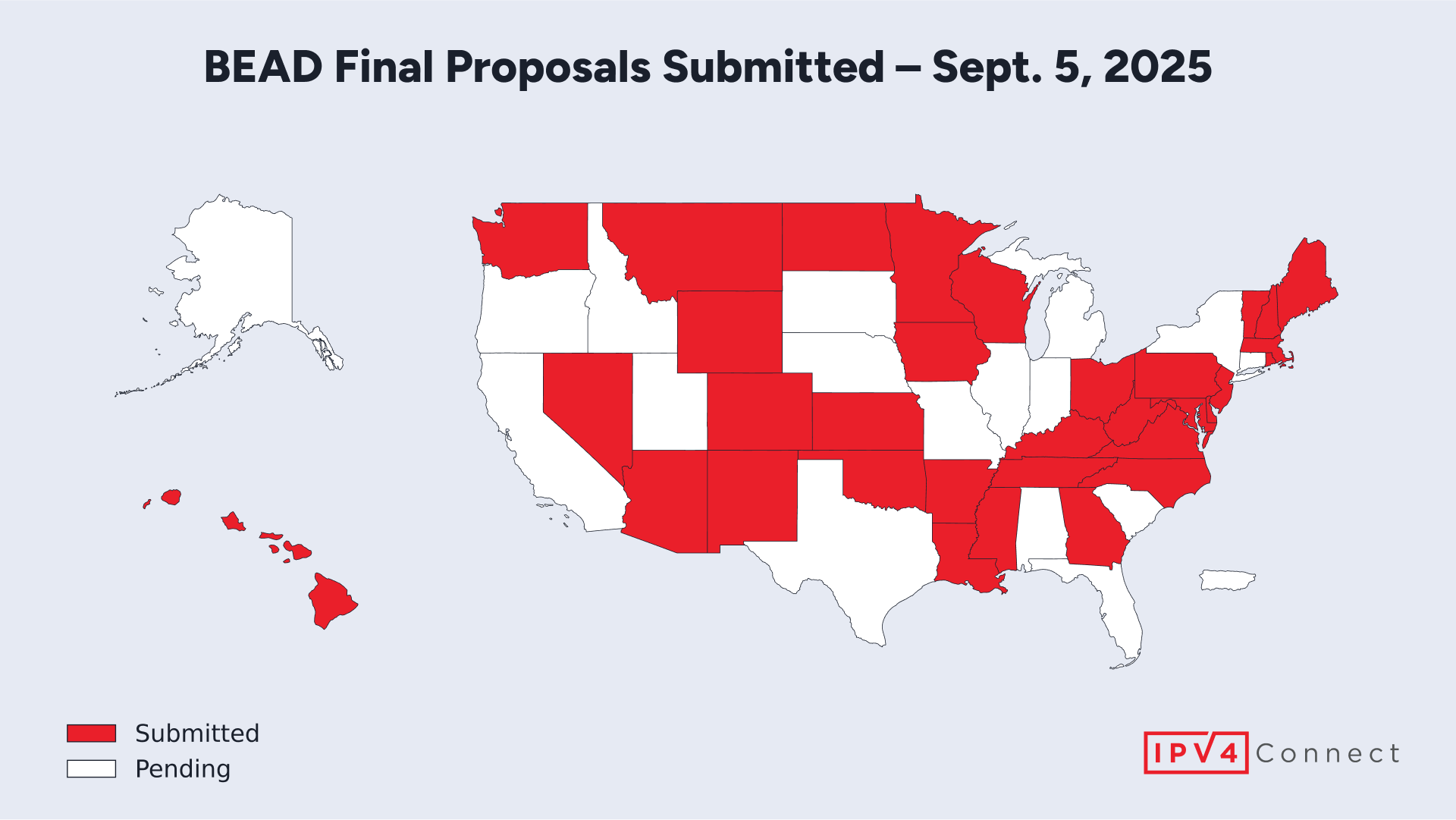

36 States Finalize BEAD Proposals Distributions Plans

After years of preparation, debate, and political shifts, the Broadband Equity, Access, and Deployment (BEAD) program is finally moving ahead to completion. Of 56 eligible states and territories, 36 have now finalized their BEAD proposals and submitted them for review.

These submissions detail how billions in federal funds will be invested to close connectivity gaps nationwide. They also mark a turning point after policy shifts under the Trump administration, where broadband offices have faced changing rules, delays, and uncertainty.

At this stage, the NTIA has 90 days to review and approve each plan, unlocking the next round of BEAD disbursements.

For up-to-date information, Brander Group maintains a BEAD progress dashboard tracking state progress, how much funding is on the table, and the technologies being deployed.

Emerging Trends Across State Proposals

The 36 finalized BEAD proposals reveal some patterns:

- Fiber Priority – Fiber continues to receive the majority of awards. In most cases it remains the central technology for closing access gaps. Until this year, it was often the only option included in state plans.

- Satellite Use Expands – Several states now allocate funds to Low Earth Orbit (LEO) satellite. Hawai‘i, Kentucky, and North Carolina included satellite in their proposals to serve remote or high-cost areas.

- Fixed Wireless Increases – Fixed wireless is more prominent in BEAD than in earlier programs. Iowa, Minnesota, and other states have assigned substantial portions of their awards to wireless deployments.

- Variation in Spending Levels – Some states are deploying only a fraction of their allocations at the start. Massachusetts is committing about 12% of its funds, while Mississippi and North Carolina are spending several hundred million dollars immediately.

BEAD Proposals by Region

West

- Arizona – $512M awarded from $993M; 75% fiber, 19% fixed wireless, 5% LEO satellite.

- Nevada – $169M awarded from $416M; 64% fiber, 29% LEO, 4% fixed wireless, 3% HFC.

- Hawai‘i – $95M awarded from $150M; 82% fiber, 8% LEO.

- New Mexico – Strong focus on fiber for rural and tribal communities; LEO reserved for hard-to-reach areas.

- California, Oregon, Washington – Extensions granted; proposals expected later in 2025.

Midwest and Plains

- Iowa – $221M awarded from $415M; 51% fiber, 41% fixed wireless, 9% LEO.

- Minnesota – $380M awarded from $651M; 56% fiber, 27% LEO, 17% fixed wireless.

- Wyoming – $136M awarded from $348M; 70% fiber, 20% fixed wireless, 10% LEO.

- Other Plains states (ND, SD, NE, KS) – Fiber remains the priority, but wireless shares are higher than in other regions.

South

- Mississippi – $567M awarded from $1.2B; 86% fiber, 13% LEO, 1% HFC.

- Kentucky – $377M awarded from $1B; 68% fiber, 25% LEO, 6% wireless.

- North Carolina – $408M awarded from $1.5B; 68% fiber, 30% LEO, 1% HFC, 1% wireless.

- Georgia, Oklahoma, Texas – Large awards to fiber, with limited satellite allocations.

- Louisiana, Arkansas, Tennessee – Fiber-focused, with modest allocations to wireless and satellite.

Northeast and Mid-Atlantic

- Massachusetts – $18M awarded from $147M; 53% HFC, 25% LEO, 22% fiber.

- Rhode Island – $16M awarded from $108M; 80% fiber, 15% wireless, 4% LEO.

- Maine – Reduced planned spending from $272M to $48M; 85% fiber, 10% wireless, 5% LEO.

- Delaware, Maryland, New Jersey – Fiber-heavy, with limited satellite support.

- New Hampshire, Vermont, Connecticut – Smaller states, primarily fiber-focused.

Mountain States

- Colorado, Utah, Montana, Idaho – Fiber dominates, with wireless and satellite included to reach remote areas.

The Role of Satellite

Satellite has emerged as a larger factor in BEAD this year. In earlier rounds, most states treated fiber as the only viable option, but 2025 proposals now show growing awards for Low Earth Orbit (LEO) providers such as SpaceX’s Starlink and, more recently, Amazon’s Project Kuiper.

These awards are often smaller in dollar terms than fiber or wireless, suggesting that satellite providers are bidding aggressively to win early market share. While this strategy broadens competition, it also raises concerns about whether the bids reflect sustainable service costs.

Performance remains a question. Starlink has scaled quickly but faces scrutiny over latency, bandwidth variability, and long-term affordability. Amazon Kuiper only began launching satellites in late 2023 and is not yet a proven commercial service. States awarding Kuiper contracts in 2025 are effectively betting on a network still in development.

The advantage of satellite is reach. It can connect remote or geographically challenging areas where fiber and wireless are too costly. But the drawback is risk: if satellite networks fail to deliver consistent service, those communities could be left behind once again. For this reason, most states treat satellite as a gap-filler rather than a foundation, supplementing fiber and wireless rather than replacing them.

20 States Remain

With 36 states and territories submitted and 20 still operating under extensions, BEAD is entering its most critical phase. The NTIA’s 90-day review process is now underway, and approvals will determine how quickly funds move from planning to construction. Delays in this stage could push projects further into 2026, while timely approvals would allow the first major BEAD-funded builds to begin quickly.

The states that received extensions — including large ones like California and Texas — will play an outsized role in national totals. Their pending submissions could add billions more to the deployment pipeline and shift the balance of technologies if they diverge from the current mix.

For providers and policymakers, the current set of proposals already signals a shift from earlier broadband programs. Fiber remains the foundation, but states are now willing to incorporate wireless and satellite to meet coverage requirements and avoid leaving communities behind.

As funds begin to flow, the central questions are whether these allocations can deliver on the promise of universal access — and whether the technology decisions made in 2025 will hold up under the demands of the next two decades.

More on BEAD and Broadband

- More of our recent stories about BEAD and public broadband programs

- For up-to-date information on the $42 billion BEAD Program, check Brander Group’s BEAD funding progress dashboard

Leave a Reply