IPv4 Market Demonstrates Stability Amid Regulatory and Economic Turbulence

Stability After a Brief Dip

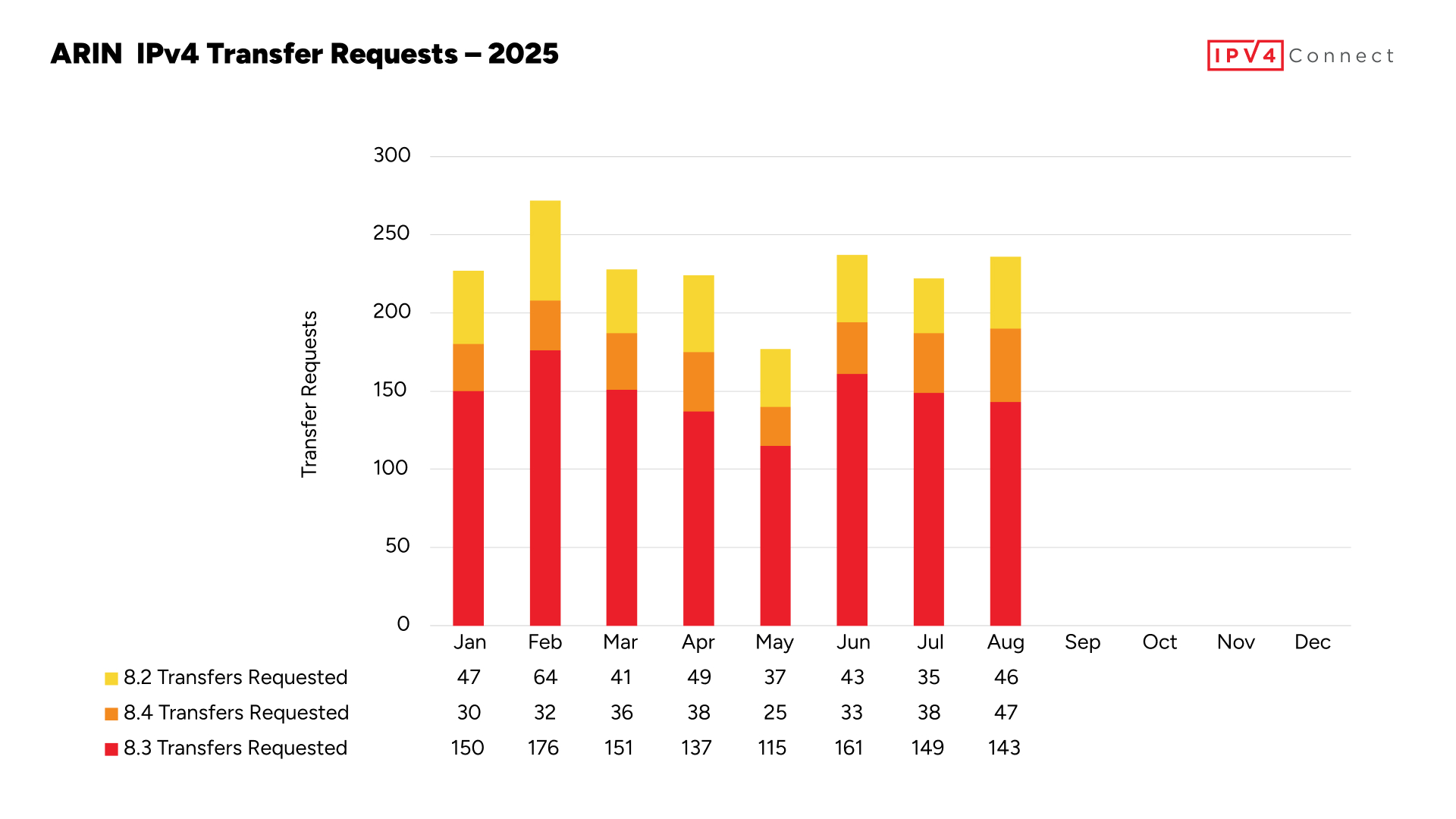

The IPv4 transfer market continues to show resilience. May’s low point of 115 transfers was short-lived, with activity quickly rebounding. Since then, 2025 has averaged 147 transfers per month, with 151 over the last three months — a sign of consistent demand in a cautious economic climate.

Pricing Pressure Eased by Supply

Despite steady activity, prices have not surged. Ample supply has tempered the market, as organizations continue to release unused IPv4 blocks. This availability keeps costs competitive, giving buyers room to secure space without aggressive price hikes.

What’s Holding Prices Down

Two dynamics are keeping the market balanced:

- Ongoing sell-side activity as holders monetize unused space.

- Strategic buyer patience, with many ISPs conserving resources ahead of BEAD funding.

Both forces have prevented the kind of sharp increases seen in previous years.

Looking Toward 2026

The real test may come in early 2026, when BEAD’s $42 billion is released and broadband providers scale up deployments. Increased competition could alter pricing dynamics quickly.

For now, the environment remains favorable:

- Buyers can acquire IPv4 at accessible levels.

- Sellers benefit from a liquid, active market.

The May slowdown is already a footnote. What matters is the IPv4 market’s resilience — and its potential for change once federal funding starts flowing.

More on BEAD and Broadband

- BEAD Rule Changes: Everything you need to know

- More of our recent stories about BEAD and public broadband programs

- For up-to-date information on the $42 billion BEAD Program, check Brander Group’s BEAD funding progress dashboard