IPv4 Market Activity Rebounds Amid BEAD Delays

Following a sharp dip in May, IPv4 transfer activity surged in June—signaling renewed strength in the market. Despite ongoing regulatory uncertainty and uneven infrastructure investment, demand for IPv4 appears resilient, shaped by macroeconomic shifts, evolving digital priorities, and delays in federal broadband support.

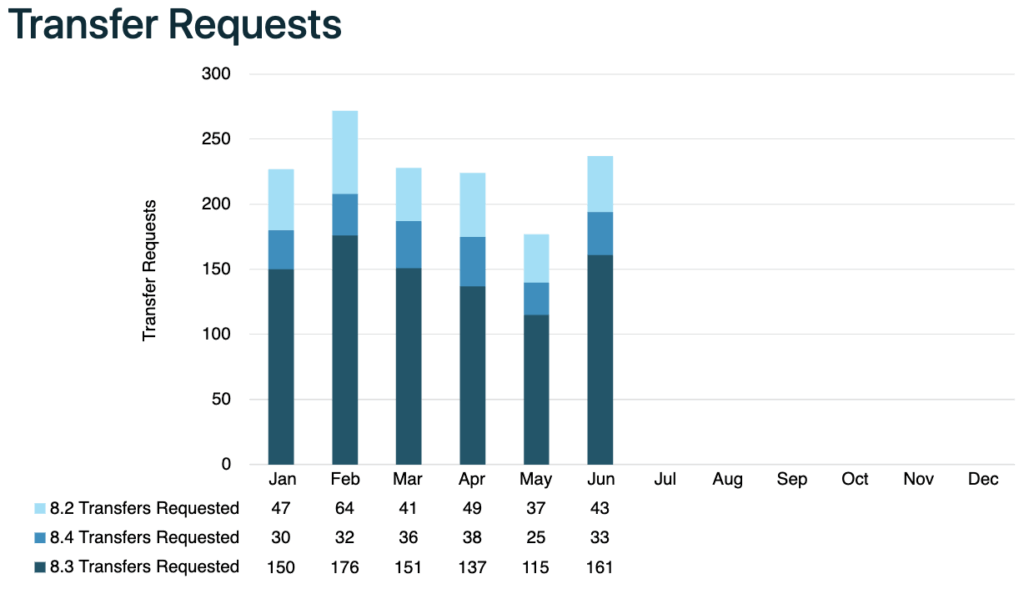

According to ARIN’s published transfer request logs and Brander Group’s tracking, May saw a 22% drop in transfer activity compared to the 2025 monthly average. That decline was quickly reversed in June, with transfer requests climbing 40% month-over-month, reaching 161. This figure also represents a 5% increase above the 2025 monthly average of 154—bringing June’s pace back in line with the highs seen earlier in the year.

The rebound in June underscores that market demand remains intact, even as the ecosystem navigates shifting federal priorities and persistent funding ambiguity.

ISPs Hesitate as BEAD Rollout Remains Unclear

Much of the market’s recent volatility traces back to the delayed rollout of the $42.5 billion BEAD (Broadband Equity, Access, and Deployment) program. Initially designed to accelerate broadband expansion in underserved areas, the program has struggled under shifting policy guidelines, changing eligibility rules, and a lack of clear timelines from federal agencies.

May’s dip in transfer activity likely reflected this uncertainty, as smaller ISPs put projects on hold, awaiting guidance. Further fueling hesitation were rumors that portions of BEAD funding might be redirected toward satellite providers like Starlink—adding confusion and concern for fixed-line operators already under pressure from rising costs and regulatory delays.

June Transfer Patterns Reflect Broader Market Shifts

Brander Group’s analysis of June ARIN data reveals meaningful directional signals:

- Small ISPs were among the most active buyers, likely in response to growing regional demand and AI-driven bandwidth requirements.

- Enterprise tech companies showed signs of downsizing, transferring or selling off unused IP space during ongoing cloud migrations and post-M&A cleanup.

- The result is a dual-track IPv4 market—one where buyers are preparing for scale while sellers capitalize on latent assets.

This divergence points to a broader truth: IPv4 remains highly liquid and strategically valuable to very different types of players for different reasons.

Data Center Growth Fuels Surge in IPv4 Needs

A major factor behind this year’s record-setting IPv4 transfer volume is the relentless expansion by hyperscalers. These large-scale cloud infrastructure operators—such as AWS, Microsoft Azure, Google Cloud, and Meta—are building global networks optimized for massive compute and storage needs, particularly for AI, real-time analytics, and edge services.

Hyperscaling demands vast address space to support seamless operations across globally distributed data centers. Despite the rise of IPv6, IPv4 remains essential for compatibility, reduced latency, and lower complexity in hybrid environments. Hyperscalers tend to acquire large, contiguous blocks to streamline routing and simplify operational architecture—creating sustained, non-cyclical demand for IPv4 assets even as other parts of the market fluctuate.

Demand for IPv4 Blocks Shows No Signs of Slowing

IPv4 continues to play a central role in enabling growth. It’s not just about basic connectivity—it’s about building networks that can scale efficiently and reliably. As broadband infrastructure continues to expand, IPv4 demand is climbing—especially in markets that remain largely IPv4-native, including rural areas and emerging economies.

The durability of the IPv4 market reflects the realities of modern digital infrastructure. In an environment where organizations prioritize speed to market, cost control, and operational dependability, IPv4 stands as a proven solution. Even with higher hardware costs and delayed grant funding, network operators are moving forward—and many see IPv4 as the most stable investment in uncertain times.

In a volatile year marked by policy shifts and budget reevaluations, IPv4 remains a predictable and strategic asset.

Key Trends to Watch in the IPv4 Space This Quarter

As we enter the second half of 2025, several key dynamics will shape the IPv4 transfer market:

- BEAD Restructuring & Funding Acceleration: States may begin disbursing funds more rapidly now that new NTIA guidance is in place. This could reignite IPv4 demand among regional ISPs.

- Starlink & Federal Policy: Ongoing speculation around satellite broadband funding—especially involving Elon Musk’s Starlink and shifting relationships with the White House—could reshape who needs IPv4 and when.

- AI & Hyperscaler Expansion: The ongoing AI boom continues to drive infrastructure buildouts, increasing the need for scalable, low-latency networks—many of which still rely on IPv4 for core functions.

While June’s surge suggests the market is stabilizing, future growth will depend on policy clarity, funding execution, and continued infrastructure buildout by both hyperscalers and regional operators.

More on BEAD and Broadband

- BEAD Rule Changes: Everything you need to know

- More of our recent stories about BEAD and public broadband programs

- For up-to-date information on the $42 billion BEAD Program, check Brander Group’s BEAD funding progress dashboard