IPv4 Market Demonstrates Stability Amid Regulatory and Economic Turbulence

The internet infrastructure sector continues to face external pressure — from shifting regulations and delayed government funding to rising hardware costs and geopolitical uncertainty. Yet demand for IPv4 address space remains strong.

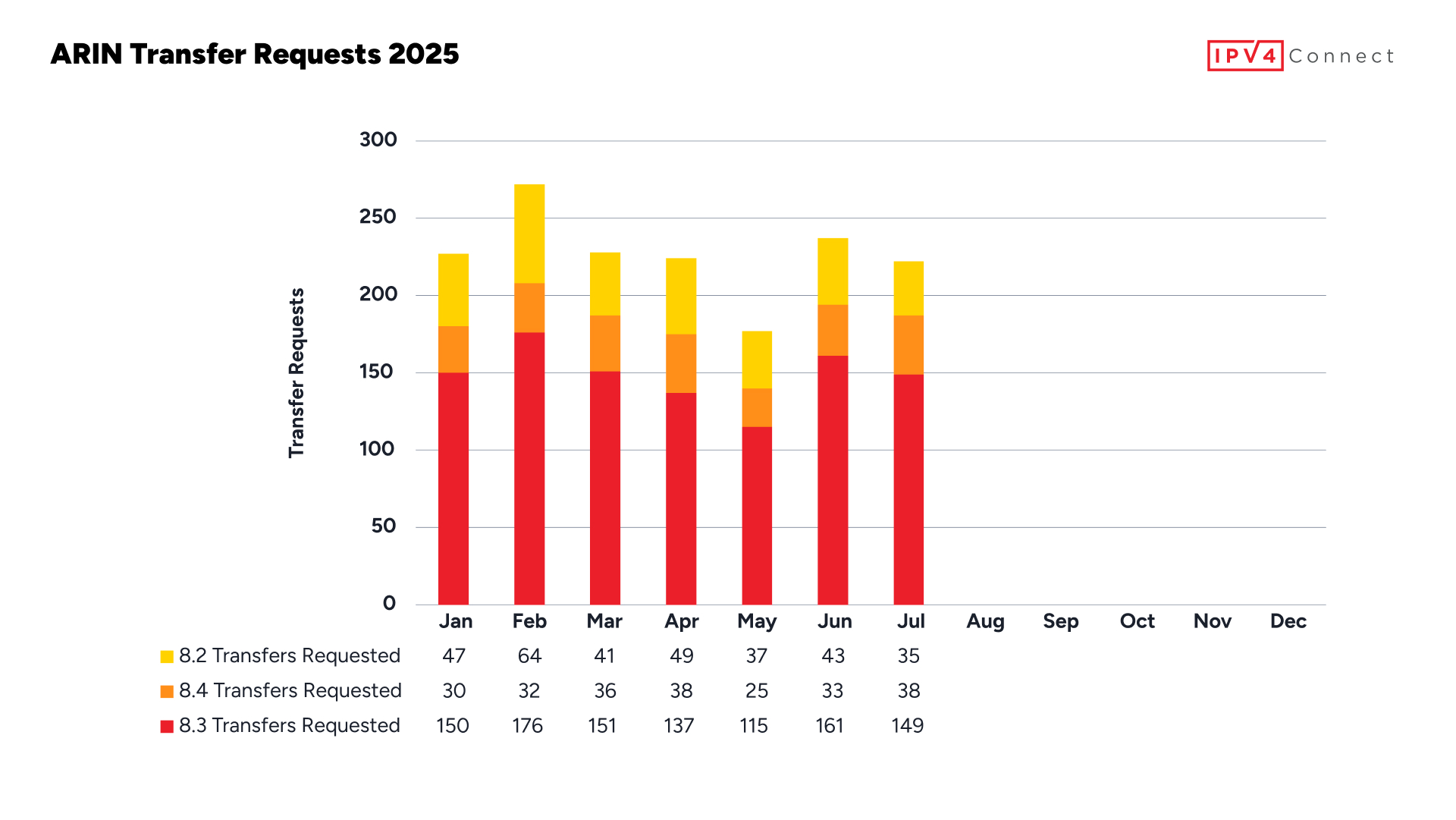

So far in 2025, the IPv4 transfer market has shown steady performance. ARIN data puts the monthly average at 146 requests — nearly even with 2024, slightly ahead of 2023, and well above 2022. That volume mirrors 2021 levels, when prices hit record highs.

In a cyclical market, this consistency matters. Despite BEAD delays and broader economic concerns, organizations are pressing forward with infrastructure plans — and IPv4 remains core to that strategy.

Key sectors continue to drive demand. Regional ISPs are planning for growth. Hyperscalers are scaling address space to support AI and cloud platforms. Enterprises are securing IP blocks ahead of potential regulatory changes. There’s no retreat — only acceleration.

Two months stand out: February and June. February saw a surge as new budgets were deployed and buyers moved early. June marked a rebound after a slower May, reflecting improved confidence around pricing and policy timelines. This is the expected rhythm of a mature, asset-backed market.

The IPv4 market has moved past a reactive mindset. Buyers aren’t waiting for ideal conditions — they’re acting when timing and strategy align. That’s operational maturity.

July confirmed the trend: 222 total requests, including 149 specified (8.3) transfers. Direct transactions continue to dominate. And despite expected monthly fluctuations, demand remains consistently high.

Importantly, this demand is functional — not speculative. IPv4 is still the backbone of global infrastructure, and it will remain so until a fully scalable alternative is in place. IPv6 adoption continues at a slow pace, and dual-stack environments are still the norm.

Looking ahead, the outlook remains solid. Budget cycles and policy changes may shift timing, but the fundamentals are clear: IPv4 demand is persistent, practical, and strategic.

In a year defined by uncertainty, the IPv4 market stands out for its reliability — a sign not just of stability, but of enduring value.

More on BEAD and Broadband

- BEAD Rule Changes: Everything you need to know

- More of our recent stories about BEAD and public broadband programs

- For up-to-date information on the $42 billion BEAD Program, check Brander Group’s BEAD funding progress dashboard